Impact of IASB’s Proposed Developments Essay Paper.

Objective of preparing this letter is providing information in context of the proposed development by IASB on account of goodwill and its impact on the organisation’s profitability. I will discuss the method applied by ABC Limited for computation as well as reporting the amount of goodwill and its treatments. Impact of IASB’s Proposed Developments Essay Paper. Mainly the letter will take into account the recent acquisition made by ABC Ltd and computation of goodwill generated on account of the same acquisition.

ORDER A CUSTOM-WRITTEN, PLAGIARISM-FREE PAPER HERE

Based on the computation made that is attached in the appendix, it can be noticed that if the entity adopts the amortisation approach the value for amortisation over the years remain same and goodwill value is reduced by constant amount. Major reason behind adopting the amortisation approach is that the value of goodwill will kept on reducing on straight line basis year after year and at the end of the life the remaining value will become nil. Impact of IASB’s Proposed Developments Essay Paper. In the given case, the value of goodwill is getting reduced by $ 127,500 in each year as amortization expenses. This approach is considered as effective for computing goodwill value however, the entity is not able to deliver actual value of the goodwill as the amortisation expenses is charged on the basis of the assumption that the life of goodwill is ten years and the goodwill is assumed at fixed rate in each year. However, in reality this may not be the case. Hence, number of analysts and investors raised concern that the amortisation approach shall not be used as it fails to provide exact value of the goodwill and the entire valuation is based on the assumption. In addition, high amount of amortisation expenses even in the later period of goodwill’s useful life will have an adverse impact on the profits of the entity that will in turn adversely impact the market value of the firm if it is not clearly mentioned through disclosures that the profit has been reduced owing to amortization expenses. Impact of IASB’s Proposed Developments Essay Paper.

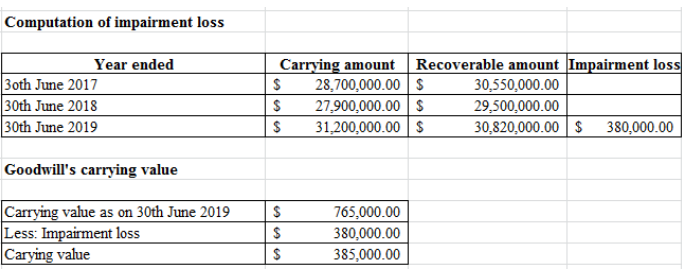

In accordance with the above presented computation it can be identified that if the entity follows the impairment-only approach the entity will not face any impairment for the year ended 30th June 2017 as well as 30th June 2018 as the recoverable amount of the goodwill is greater than the carrying amount and the impairment takes place while the carrying amount is greater than the recoverable amount of goodwill. Impact of IASB’s Proposed Developments Essay Paper.Accordingly, for the year ended 30th June 2019 the firm will report impairment loss amounting to $ 380,000 as the carrying amount exceeds the recoverable amount by $ 380,000. This amount will be charges as an expense in the income statement of the entity for the year ended 30th June 2019 and the residual value will be reported under the balance sheet for the same period.

However, this method may be considered as complex and time consuming by the users. Hence, the amortization approach may be used after keeping in mind the facts that the goodwill’s useful life is arbitrary and carrying amount of goodwill acquired after deducting the charges of amortisation will not provide the original benefits from business combination that will considerably be better as compared to impairment-only approach. Impact of IASB’s Proposed Developments Essay Paper.

Bibliography

Alao, A., 2017. The burden of collective goodwill: The international involvement in the Liberian civil war. Routledge.

Andersson, T., Haslam, C., Tsitsianis, N., Katechos, G. and Hoinaru, R., 2016. Stress testing International Financial Reporting Standards (IFRSs): Accounting for stability and the public good in a financialized world. Accounting, Economics and Law-a Convivium.

Ayres, D.R., Neal, T.L., Reid, L.C. and Shipman, J.E., 2019. Auditing Goodwill in the Post‐Amortization Era: Challenges for Auditors. Contemporary Accounting Research, 36(1), pp.82-107. Impact of IASB’s Proposed Developments Essay Paper.

Chen, W., Shroff, P.K. and Zhang, I., 2017. Fair value accounting: consequences of booking market-driven goodwill impairment. Available at SSRN 2420528.

Glaum, M., Landsman, W.R. and Wyrwa, S., 2018. Goodwill impairment: The effects of public enforcement and monitoring by institutional investors. The Accounting Review, 93(6), pp.149-180.

Ifrs.org. 2019. [online] Available at: https://www.ifrs.org/-/media/feature/meetings/2019/june/iasb/ap18b-goodwill-and-impairment.pdf [Accessed 12 Oct. 2019].

Johansson, S.E., Hjelström, T. and Hellman, N., 2016. Accounting for goodwill under IFRS: A critical analysis. Journal of international accounting, auditing and taxation, 27, pp.13-25.

Kabir, H., Rahman, A. and Su, L., 2017. The Association between Goodwill Impairment Loss and Goodwill Impairment Test-Related Disclosures in Australia. In 8th Conference on Financial Markets and Corporate Governance (FMCG).

Knauer, T. and Wöhrmann, A., 2016. Market reaction to goodwill impairments. European Accounting Review, 25(3), pp.421-449.

Li, K.K. and Sloan, R.G., 2017. Has goodwill accounting gone bad?. Review of Accounting Studies, 22(2), pp.964-1003. Impact of IASB’s Proposed Developments Essay Paper.

Mazzi, F., André, P., Dionysiou, D. and Tsalavoutas, I., 2017. Compliance with goodwill-related mandatory disclosure requirements and the cost of equity capital. Accounting and Business Research, 47(3), pp.268-312.

ORDER A CUSTOM-WRITTEN, PLAGIARISM-FREE PAPER HERE

Schatt, A., Doukakis, L., Bessieux-Ollier, C. and Walliser, E., 2016. Do goodwill impairments by European firms provide useful information to investors?. Accounting in Europe, 13(3), pp.307-327.

| Computation of goodwill amortization | |||

| Goodwill value | $1,275,000.00 | ||

| Amortization period | 10 years | ||

| Year | Amortization value | Accumulated value of amortization | Carrying value |

| 1st July 2016 | $- | $- | $1,275,000.00 |

| 30th June 2017 | $127,500.00 | $127,500.00 | $1,147,500.00 |

| 30th June 2018 | $127,500.00 | $255,000.00 | $1,020,000.00 |

| 30th June 2019 | $127,500.00 | $382,500.00 | $892,500.00 |

| 30th June 2020 | $127,500.00 | $510,000.00 | $765,000.00 |

| 30th June 2021 | $127,500.00 | $637,500.00 | $637,500.00 |

| 30th June 2022 | $127,500.00 | $765,000.00 | $510,000.00 |

| 30th June 2023 | $127,500.00 | $892,500.00 | $382,500.00 |

| 30th June 2024 | $127,500.00 | $1,020,000.00 | $255,000.00 |

| 30th June 2025 | $127,500.00 | $1,147,500.00 | $127,500.00 |

| 30th June 2026 | $127,500.00 | $1,275,000.00 | $- |

| Computation of impairment loss | |||

| Year ended | Carrying amount | Recoverable amount | Impairment loss |

| 3oth June 2017 | $28,700,000.00 | $30,550,000.00 | |

| 30th June 2018 | $27,900,000.00 | $29,500,000.00 | |

| 30th June 2019 | $31,200,000.00 | $30,820,000.00 | $380,000.00 |

| Goodwill’s carrying value | |||

| Carrying value as on 30th June 2019 | $765,000.00 | ||

| Less: Impairment loss | $380,000.00 | ||

| Carying value | $385,000.00

Impact of IASB’s Proposed Developments Essay Paper. |