Inflation in the United Kingdom’s Economy

The Office of National Statistics (ONS) says that the rate of inflation has risen to 0.2% in December 2015. It was surprising because it became the first month when the number exceeded 0.1% of January 2015. The primary causes of this increase are seen in the rise of “transport costs, particularly airfares, and to a lesser extent motor fuels” (Collinson 2016, par. 2). Nevertheless, the mentioned rate of inflation falls within the 2% target set by the Bank of England and is still one of the lowest levels in the history of the United Kingdom’s economy.Inflation in the United Kingdom’s Economy.

Causes of the problem

The chosen article refers to the concept known as cost-push inflation when inflation is the response to the increase in prices where there is stable demand in the economy (Amadeo 2016). This rate was caused by transportation and fuel costs. However, as it was noted by Maike Currie, investment director, the emerging world experiences a continuous slowdown in the economy and the demand is extinguished by the global manufacturing sector (Collinson 2016).Inflation in the United Kingdom’s Economy. It means that there is no threat of skyrocketing inflation rates in the longer run. Moreover, the Bank of England does not change the interest rates, so the inflation will remain stable and within the planned 2%.

ORDER A PLAGIARISM-FREE PAPER NOW

Problem evaluation

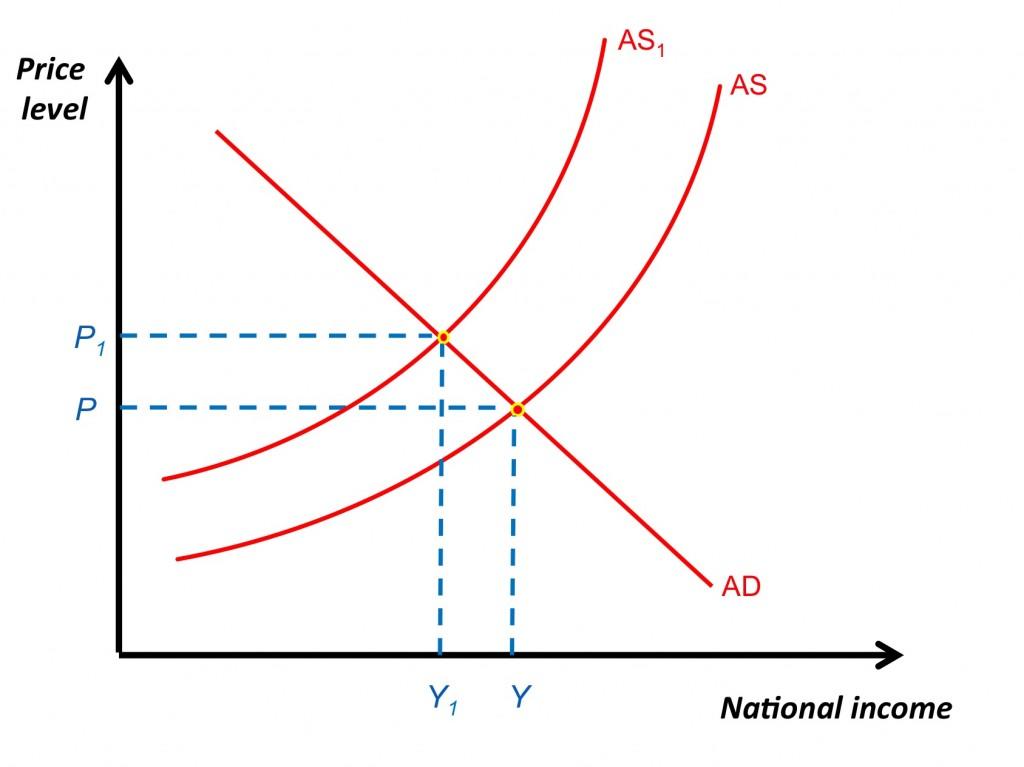

Nevertheless, if there were a risk of the inflation rates exceeding the set target, the Bank would have to intervene in the economy to fix the situation. In the case of cost-push inflation, the aggregate supply curve moves to the left, thus, increasing the level of prices (Cartwright 2016). In the long run, it leads to establishing the new equilibrium in the economy – one with a higher level of prices and a lower level of national income (see Figure 1). In a similar situation, the government usually takes a wide range of actions including the contractionary fiscal policy with higher taxes and lower spending and raises the interest rates. The primary purpose of the mentioned activities is to reduce the aggregate demand that would stop the growth of prices. What is also beneficial for reducing cost-push inflation is carrying out supply-side policies including such measures as better infrastructure, education, and training, deregulation, etc. Inflation in the United Kingdom’s Economy.Another option is to tighten the monetary policy introducing higher interest rates that will have the same effect in the long run.

Solving the problem

Even though these steps have a positive impact on the inflation rate in the long run as the AS curve moves back to the left, they can be a source of negative outcomes in the short run. For example, raising interest rates will stop the growth of inflation but as well lead to a fall in gross domestic product or push the economy in the recession because both ordinary consumers and firms could not comply with the new economic conditions. In addition to it, they will affect the exchange rate and lead to unemployment in the short run.

Conclusion

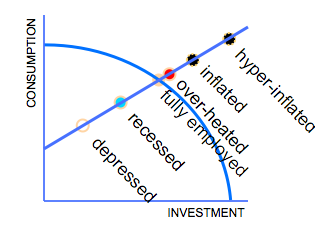

Another way to analyze the economy is to define whether it operates on its production possibility frontier (PPF). PPF can also be used for estimating the inflation rate and the state of the economy. That said, if the economy is pushed far outside PPF, it will experience inflation or even hyper-inflation (See Figure 2).Inflation in the United Kingdom’s Economy.

What should be done in practice is, first, targeting the inflation, i.e. defining the desired and acceptable inflation rates. Second, in the case, if it exceeds the set target, it is vital to define the nature of factors. If they are temporal such as price shocks or natural disasters (Amadeo 2015), there is no need for the government to take any actions because the economy will return to normal functioning without intervention. It is what happened in the example provided in the article. Inflation in the United Kingdom’s Economy. The demand for fuel is inelastic because no matter what the price is, people and companies will buy it. But there are no other signs of reasons for higher inflation rates. That is why the government should remain neutral.

References

Amadeo, K 2015, What Is Cost-Push Inflation?’, Web.

Amadeo, K 2016, Causes of Inflation: 3 Real Reasons for Rising Prices, Web.

Cartwright, B 2016, Low and Stable Rate of Inflation Series: Cost-Push Inflation, video, channel Brad Cartwright Economics, Web.

Case, K E, Fair, R C & Oster, S M 2013, Principles of macroeconomics, 11th edn, Prentice Hall, Upper Saddle River, NJ.

Collinson, P 2016, ‘UK Inflation Rises Unexpectedly,’ The Guardian, Web.

Margetts, S 2013, Inflation and Deflation, Web. Inflation in the United Kingdom’s Economy.

In order to close this inflationary gap, the government should use deflationary FP. By decreeing government spending (G), (therefore decreasing injections into AD), or increasing taxes (T), (increasing withdrawals from the economy), disposable income of the population can be reduced, and in turn AD can be decreased. In figure 3 the inflationary gap is shown, with the gap a-b displaying E>Y and c-d displaying W>J at the full employment level of national income. Other uses of FP include changing the tax system to provide more incentives to increase AS, or to alter the distribution of income, again through increases in T. One major problem with FP is that it is severely affected by time lags. Inflation is difficult to forecast, and in order to smooth out the business cycle, policy must be implemented at the right time, and with the necessary magnitude. Inflation in the United Kingdom’s Economy. If the policies implemented fail to work within these two limits, they could extend a boom period of unstable growth, or deepen a recession further, and so must be carefully implemented. These policies all work to combat inflation; however they could all prove detrimental to the British economy in it’s present state. Monetary policy, ‘The government’s policy relating to the money supply, bank interest rates, and borrowing’ (Collin: 130), is another tool available to the government to control inflation. Figure 4 shows, that by increasing the interest rate (r), from r1 to r2, the supply of money (ms) is reduced from Q1

The economy of the United Kingdom in the 1970s was on a slow growth rate with increased unemployment and high inflation rates. This is similar to the early 2000s but recently the United Kingdom has experienced better economic growth increased trade and relatively low unemployment levels as compared to other European nations.

During the 1970s the economy was considered to be faced with structural and functional problems with an inflation of about 27%. There was also rise in the power of trade unions which resulted in wage inflation and strikes among workers. Despite this the unemployment rose to a record 700,000 in the end of 1970s.During this period there were also increased government debt. In the 1970s the UK economy grew at a slower rate than that of the neighbouring European competitors. Britain’s share of world trade at the same time halved between the period between 1990 and early 1970s. Inflation in this period was given exacerbated by hike in oil prices in1973. The UK microeconomic performance also declined in relation to other economies and previous periods. Inflation in the United Kingdom’s Economy.

ORDER A PLAGIARISM-FREE PAPER NOW

During these two periods i.e. between 1970s and 2000 there are two steps used to evaluate the economy this definitely cannot be purely objective. The following performance indicators have been used for evaluating the economy in these two periods. Economic growth; This is best expressed by looking at the Gross national product which compares the population size to the value of both goods and services produced and consumed. Economic stability: This refers to the extent of fluctuations and variations in employment levels economies, currency, prices and inflation. International balance of trade: This looks at the performance of the economy internationally by its trade balance exchange rates. Balance of payment and trade.

In the year 2009 the United Kingdom was ranked as the sixth biggest economy in the world with a GDP of US$2,646. The UK also received the highest number of FDI in Europe In the same year 2008. The economy also grew at a faster rate than that of the neighbouring economies. In the year 2008 the level of employment in the UK was also lower than that of the European Union. The economic growth at the European Union was at 0.6% in 2008.

Conclusion

The United Kingdom has greatly progressed in the 2000s as compared to the 1970s when there was economic experimentation in terms of policies and ideologies. The united kingdom has shown increased and better improvement as compared to the European union this is because of solid programmes and favourable policies. The rate of inflation has been high during both periods. However during the same period global inflation rates were also high. Inflation in the United Kingdom’s Economy.